Labour is today publishing its plans to reform the banking sector so that it better supports growing businesses, economic growth and rising living standards.

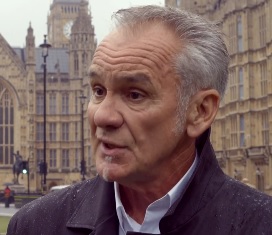

Cllr Mick Lerry said: “Too often in recent years our banks have fallen far short of the standards expected of them. After so many scandals we need major reforms and long-term cultural change to restore trust and ensure our banks start working for consumers and businesses again”.

We need much more action than this government has been prepared to take. So Labour’s banking reform paper sets out how we will change rules on bonuses, increase competition and get more lending to small and medium-sized businesses.

We will extend to at least ten years the period bank bonuses can be clawed back in cases of misconduct.

“As we have seen in recent days, wrongdoing can take years to uncover. The current proposals to claw back bonuses are too weak and do not cover a long enough period of time. We will ensure people involved in misbehaviour and misconduct would have to give back their bonuses for at least a decade after they have been paid out” said Mick.

And we will establish a proper British Investment Bank to help growing businesses get the funding they need to expand and create jobs. Because it’s only when working people and businesses succeed that Britain succeeds too.”

Labour’s economic plan

The banking reform paper is part of Labour’s economic plan and sets out a series of measures the next Labour government will take, including:

• Extending clawback of bank bonuses that have already been paid in cases of inappropriate behaviour to at least 10 years and enacting legislation, passed by the last Labour government, to require banks to publish the number of employees earning more than £1 million.

• Creating a proper British Investment Bank to provide vital funding for small and medium-sized businesses. All funds raised from the planned increase in the licence fees for the mobile phone spectrum – estimated to be up to £1 billion in the next Parliament, subject to Ofcom consultation – will be allocated to the British Investment Bank.

• Introducing a one-off tax on bankers’ bonuses to help pay for Labour’s Compulsory Jobs Guarantee – a paid starter job for all young people out of work for 12 months or more, which people will have to take up or lose their benefits.

• Addressing the lack of competition in the sector. We welcome the Competition and Markets Authority inquiry, which we called for and want to see at least two new challenger banks and a market share test to ensure the market stays competitive for the long term.

• Extending the levy on the profits of payday lenders to raise funding for alternative credit providers.

End

Cllr Mick Lerry-Leader of the labour Group on Sedgemoor District Council

Labour Parliamentary Candidate for Bridgwater and West Somerset Constituency